Everything You Need to Know About Centiiv Pay

Africans have decried the issues they encounter while making cross-border remittances. These include high transaction fees they have to pay before they can get their funds to the receiving end. Also, remitting funds internationally comes with its own hassles as it requires individuals to fulfil a couple of unnecessary requirements.

The need to have an easy remittance method in Africa cannot be emphasized enough. The stress an individual has to go through to be able get his/her funds sent across really is not necessary. Speaking about the high fees that have to be compulsorily paid is another problem that requires urgent attention.

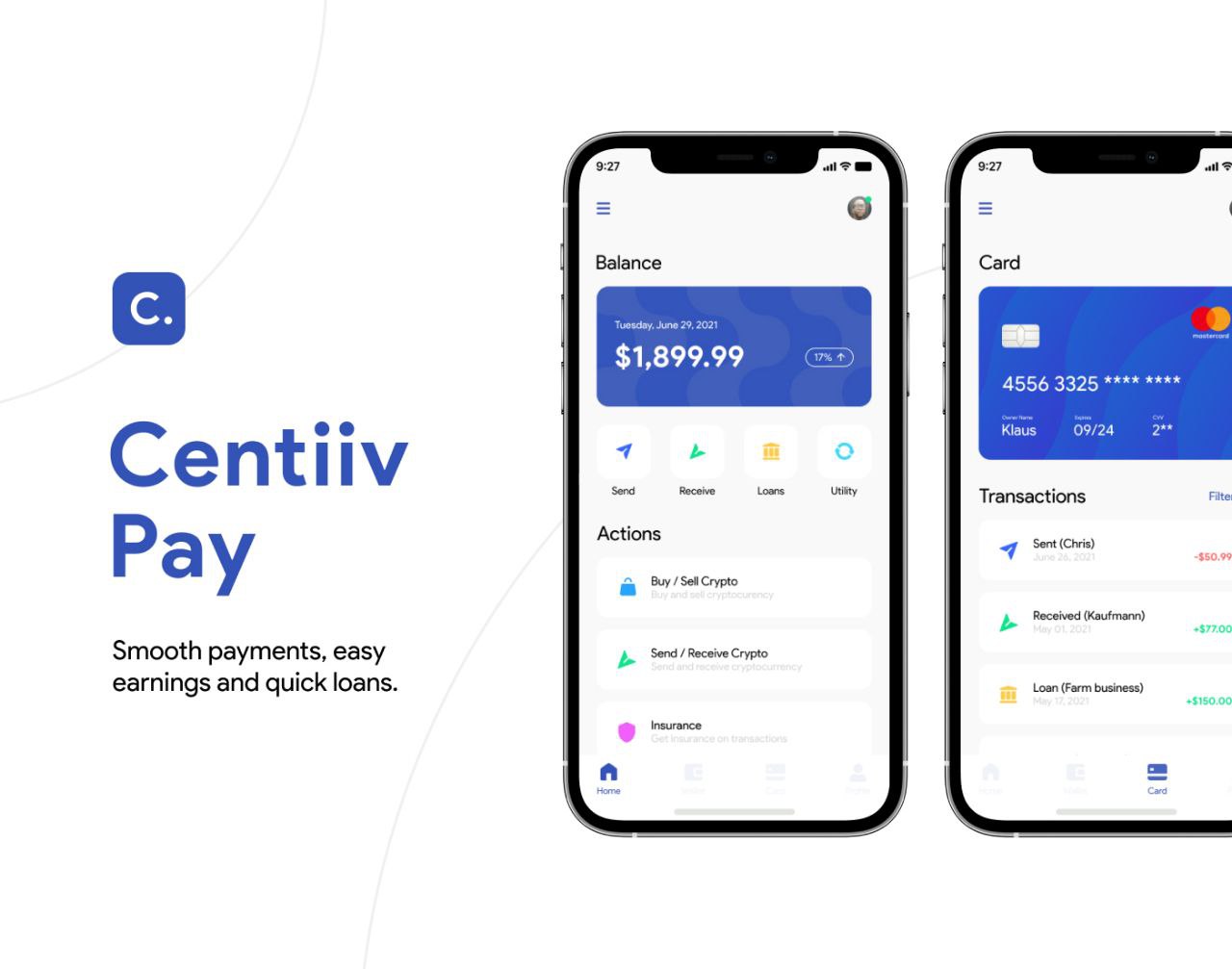

The outlook of cross-border in Africa no doubt needs to be looked into and this is the reason Centiiv Pay came into the picture. Centiiv Pay is a “yet-to-launch” peer-to -peer remittance platform being built on the Blockchain to facilitate a fast and hassle-free remittance of funds across Africa. The need to maximise the use of Blockchain technology in Africa is the sole reason Centiiv Pay is being built. The platform provides a secure and seamless environment to satisfy the needs of Africans in the area of cross-border remittance. This way, merchants who need to transact beyond the shores of their home country would find payment very easy to do which in turn would help improve their businesses.

Centiiv Pay also intends to make it easy for crypto enthusiasts to make purchases directly from their crypto wallets without having to liquidate their crypto assets. Here, users, through their Centiiv Card can spend their crypto on third party platforms.

Other features of Centiiv Pay are:

- Swap Crypto: This feature is that which would make it easy for users to exchange crypto assets right within the Centiiv Pay app. Here, a user can easily swap crypto assets without bothering about liquidity.

- Centiivest: This is the feature that would allow the members of Centiiv Community to invest in selected business ventures in various sectors such as agriculture, real estate, oil and gas to enable them to make passive income with little to no effort.

- Centiiv Loan: This is the platform where loans will be provided to cryptocurrency traders to get the best out of the crypto space. Here, the Centiiv token ($CNT) would be used as a collateral to secure loans. Crypto traders can take USDT loans to “buy the dip”… Interesting right? Merchants can also access loans via the app to help grow their various businesses.

- Centiiv Insurance: This is the feature that gives users of the Centiiv Pay access to insurance in the event of unforeseen losses. “God forbid wallet hacks, losses or liquidations”, but when it happens, Centiiv is willing to cover you to minimize the losses.

Centiiv Pay would have the android and IOS versions and is intended to launch in the first quarter of 2022. The launch of Centiiv Pay would definitely solve a lot of problems Africans currently face in the area of cross-border remittances. Also, it is a platform that would help Africans make passive income.